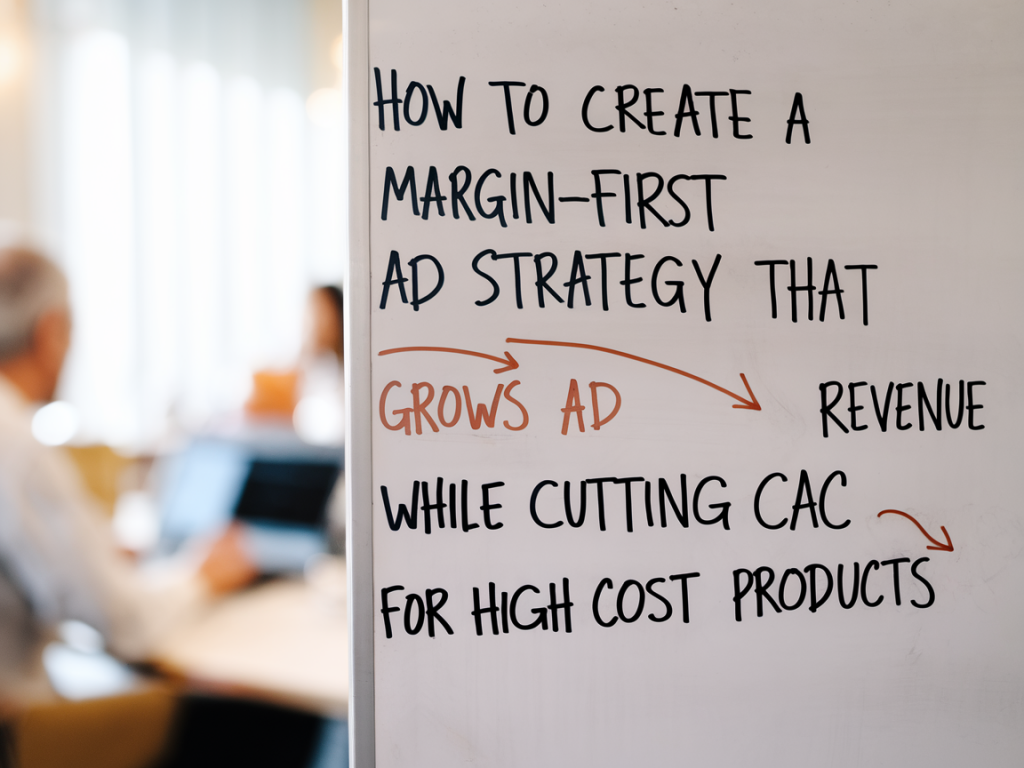

When you sell high-ticket products, the temptation is to treat advertising like a volume game: spend more, get more customers. I’ve learned the hard way that for expensive products — think premium appliances, B2B SaaS tiers, or niche professional services — that approach kills unit economics fast. Instead, you need a margin-first ad strategy that prioritizes profitability per acquisition while still growing revenue. Below I share the framework I use with clients to cut CAC, protect margins and scale responsibly.

Why margin-first matters for high-cost products

High-cost products often come with higher acquisition friction, long sales cycles and larger refund/return risks. If you optimize solely for installs, leads or traffic, you can end up with customers who look good on acquisition dashboards but are loss-making after returns, onboarding costs and support.

When I say “margin-first,” I mean designing ad campaigns and funnels with the explicit goal of improving contribution margin per customer — not just conversion volume. That changes everything: your creative, targeting, bidding, landing pages, offers and attribution windows.

Core principles of a margin-first ad strategy

Step-by-step framework I use (and teach)

This is the playbook I apply in engagements — adaptable to product and vertical.

1) Calculate your true unit margin and CAC target

Start with a simple table. I recommend a spreadsheet with:

| Metric | Formula / Example |

|---|---|

| Average order value (AOV) | $2,000 |

| COGS / variable delivery cost | $600 |

| Gross margin per order | AOV − COGS = $1,400 |

| Desired contribution margin (%) | 30% → $420 |

| Target CAC | Gross margin − contribution = $980 |

If your current CAC exceeds that target, you have to either raise price, reduce variable costs, or improve conversion enough to lower CAC.

2) Segment audiences by purchase intent

High-ticket buyers come from different intent signals. Map audiences into tiers and assign different CPA targets.

I commonly pull CRM and GA data to build lookalikes from customers who reached a specific milestone (purchase + positive margin in first 90 days). That yields a much better LTV profile than lookalikes based on any purchase.

3) Change creative to sell margin, not clicks

For high-cost items, ads should qualify leads, not just attract clicks. Use elements that increase purchase intent and decrease low-quality traffic:

One client selling industrial equipment cut their Facebook spend by 40% while increasing revenue by shifting to lead forms that asked for project budget and timeline — fewer leads, but vastly higher close rates.

4) Optimize funnel for margin, not lead volume

Every funnel step should be measured for how it changes unit economics:

Run experiments where you trade volume for quality deliberately. For example, adding a single qualifying question in a lead form often reduces lead count by 30–60% but increases conversion-to-sale by 2–4x.

Attribution and bidding tweaks that protect margin

Default auto-bidding and last-click attribution can bury margin signals. I recommend:

Example: a subscription software client turned off broad prospecting for a month in specific regions and saw overall revenue fall less than ad-attributed conversions suggested — that meant those campaigns were cannibalizing organic demand and weren’t truly incremental.

Pricing, offers and financing are part of the ad strategy

Ads alone won’t make an unprofitable price work. Consider these tactical moves:

I often run a simple sensitivity analysis: what happens to contribution margin if AOV changes −10% or CAC changes +20%? If you're brittle, you need to adjust price or backend monetization before scaling ad spend.

Operational changes that reduce effective CAC

Some of the biggest CAC improvements come from non-marketing fixes:

For one client, improving lead response time from 48 hours to under 4 hours reduced their average CAC by 22% because close rates jumped dramatically.

Metrics and dashboards I track

Set up a dashboard with these KPIs per channel and campaign:

Example KPI: if your gross margin per order is $1,400 and paid CAC is $900, your contribution margin is $500. If you add an onboarding program that increases second purchase rate by 10%, your effective LTV rises and CAC tolerance improves — that’s the compounding effect you want to track.

Quick checklist to start today

Margin-first advertising is less sexy than chasing vanity metrics, but for high-ticket products it’s the difference between growth that lasts and growth that loses money. If you’d like, I can share a spreadsheet template that calculates CAC tolerance and payback for your product — or walk through a quick audit of your current funnels and KPIs.